KongaPay projected to hit 3m subscribers by 2022

KongaPay, a Central Bank of Nigeria (CBN)-licensed fintech platform, is on course to grow its active subscriber base to over three million by 2022, data released by the company has shown.

The mobile money platform, the leading provider of digital services for e-commerce shoppers in Nigeria, is one of the thriving subsidiaries within the Konga Group, Nigeria’s e-commerce giant.#

Feelers from within the company indicate that KongaPay was recently repositioned to take a greater share of the payments market in Nigeria, a development that has seen the platform taking the fintech space by storm.

The move has seen KongaPay – which has witnessed an astronomical 400% rise in adoption, growing from about 272,000 to 1.1 million subscribers within a space of less than three months and from a paltry 81,000 wallets at the point of acquisition in 2018 by the Zinox Group – now on its way to tripling its subscriber numbers in the next one year to over three million.

Furthermore, the management of KongaPay is also targeting an ambitious growth in active usage by 25% in 2022.

Worth emphasizing is the fact that the fintech platform has not only expanded its suite of offerings but is equally set to roll out additional smart features of great products and services offerings, a point further espoused by Isa Aliyushata, VP, KongaPay.

‘‘KongaPay is set to take a greater share of the market, in line with the exciting offerings on the cards which we are set to unveil soon. We have not only enjoyed greater engagement and increased transactions from our existing subscribers but have also seen a huge leap in adoption by new subscribers.

‘‘KongaPay is currently growing at a rate of 400% month-on-month and we are envisaging our subscriber base to hit and possibly exceed the three million mark by 2022. This is all down to the hard work still ongoing behind the scenes to make KongaPay the payment platform of choice for millions of Nigerians, the loyalty and confidence we have enjoyed from Nigerians, as well as the smart features and additional products and services we are adding to our growing bouquet of offerings.

As we continue to take pride in our great vision to constantly solve the challenges of the payment ecosystem globally, KongaPay remains relevant in the minds of its customers with great innovation and hybrid technology solutions,’’ he stated.

Meanwhile, KongaPay was recently identified by Statista, a globally renowned market and consumer data firm, as the leader in providing e-payment services for e-commerce transactions in Nigeria and a foremost enabler of online shopping in Africa’s biggest market.

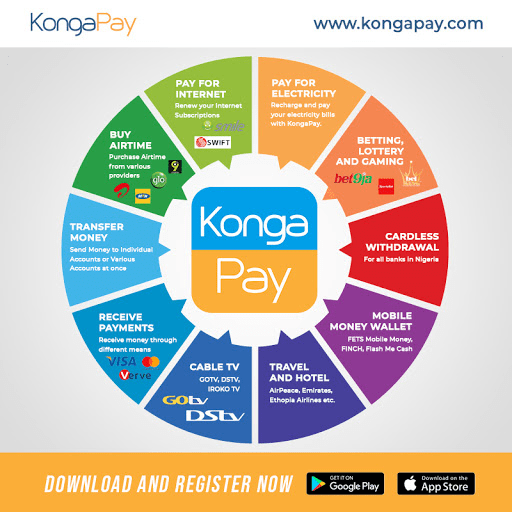

A robust and reliable digital payments platform, KongaPay offers a long list of services to subscribers including cardless withdrawals for all banks in Nigeria, money transfer to individual accounts or various accounts at once, receiving payments from customers, creditors or benefactors through a variety of means, airtime purchase from various telcos or network providers such as MTN, Airtel, Glo and 9Mobile, etc., payment for or renewal of internet subscriptions, recharge and payment for electricity digitally, renewal of cable TV subscription including DSTV, GOTV, IrokoTV, etc., payment for flights, travel and hotel accommodation, funding of sports betting, lottery and gaming accounts, while also functioning as a mobile money wallet, among others.

KongaPay is also in the forefront of promoting financial inclusion across the reached, the unreached and under-served segments of the populace.

Specifically, the platform is deepening the scope of Point of Sales (POS) transactions in Nigeria with the aggressive deployment of mobile money agents across the nooks and crannies of Nigeria. KongaPay is confident of adding 10,000 POS agents nationwide by end of financial year 2022.

Launched in 2015, KongaPay debuted as a pilot product in partnership with Nigerian commercial banks in response to concerns expressed by customers about the confidentiality of their details while trying to make payment for products on the Konga website.

Since inception, the platform has grown immensely and under the drive of the new management of Konga, is leading the new-found appetite for digital payments among e-commerce patrons and other subscribers, processing tons of transactions daily.

The company has also recently extended its services to Nigerians in the Diaspora, many of whom have often struggled to find a reliable way to extend support to their families and relatives back home, make payments to suppliers or even receive payment for the goods and services they sell locally.