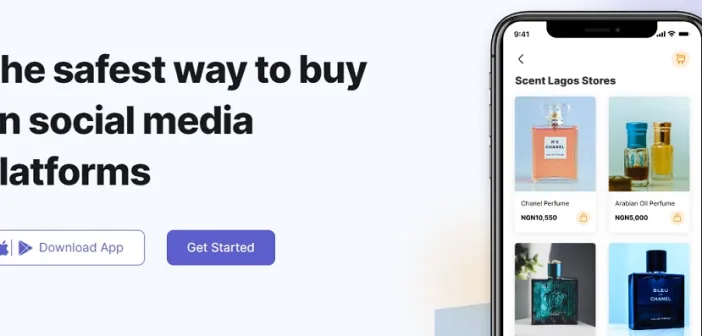

How Nigeria’s Peppa makes social internet shopping in Africa safer

Peppa, a Nigerian startup, is making it safer to shop online in Africa, with a focus on social buying and selling, by offering a payment protection plan that protects buyers from fraud and sellers from losses caused by cancelled orders.

Peppa, founded in September 2021 but conceptualized much earlier, allows users to make payments for goods on social commerce platforms in a secure and easy manner.

“From cases reported online, we noticed an increase in cases of money losses due to ghost-sellers – who get paid but never deliver goods,” said Banky Alao, co-founder and CEO of Peppa.

“While 70 per cent of people aged between 18 and 45 start their shopping on social platforms, the lack of a safety net for cases where the seller does not deliver goods has discouraged many from shopping on these social platforms.”

Alao said uptake has been “very exciting”.

“We already had 3,000 buyers on our app even without publicly launching the product,” he said. “Our verified seller count stands at 1,500 today while we have distribution partnerships with the continent’s leading mobile money operator and a leading bank in Nigeria.”

Peppa is one of 12 firms selected for the ARM Labs Lagos Techstars Accelerator, a Lagos-based program focused on creating early-stage prop-tech and fintech startups across Africa, and is actively raising pre-seed capital. This will allow the firm to expand across Nigeria and enter its first new market, Uganda.

“We make money from transaction fees paid when payments are made to sellers, in addition to subscription fees earned from sellers,” Alao explained.