How GetEquity is transforming startup investment in Africa

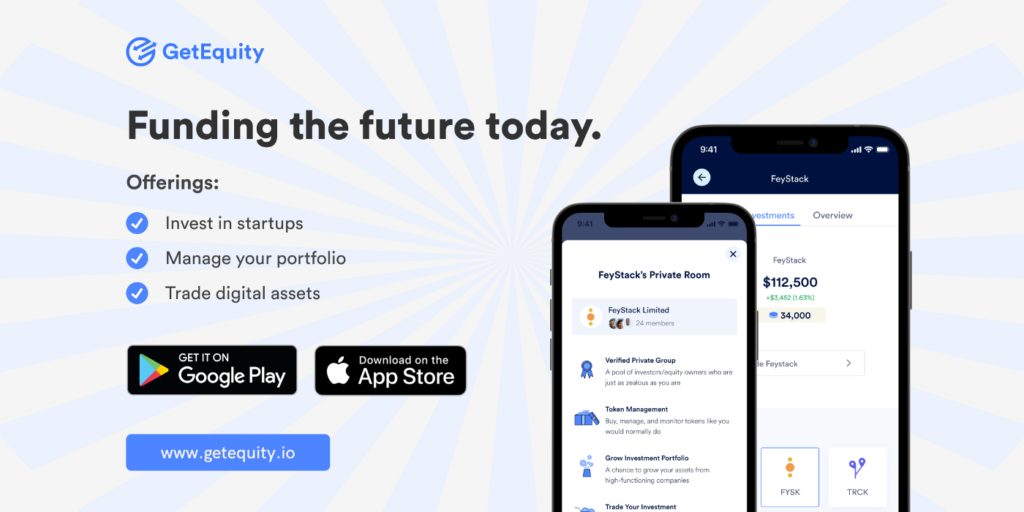

GetEquity, a Nigerian investment platform, entered the market with the goal of “challenging the status quo of startup financing and venture capital in Africa.”

The company claims it wants to make funding for African startups simple and quick, while also allowing ordinary people to participate in the thriving startup ecosystem.

Looking back on its activities, that mantra does not appear to be a marketing ploy; the startup is indeed walking the walk. But how is it accomplishing this?

GetEquity, co-founded by Jude Dike, William Okafor, and Temitope Ekundayo, and launched in July of this year, is the result of several iterations. The co-founders did not set out to democratize startup investment in Africa at first. Dike and Okafor, both blockchain engineers, were working on a blockchain exchange platform, while Temitope was developing a big data analytics product. However, after being accepted into the Mozilla Accelerator, the trio realized that they could “merge forces” and create one of Africa’s most innovative products.

“I met Temitope at the Mozilla Accelerator after we’d been chatting on Twitter for a while.” “Because I and William are technical people and Temitope is a business operator, I asked Temitope to help us figure out the business side of our product while we helped him build a technical team for his product,” said Dike, CEO of GetEquity. Apparently, this was the ostensible skill trade that would lead to the establishment of GetEquity.

This is how disruption appears

Consider the following: Shola, 25, wants to invest in a high-growth startup but doesn’t know where to begin, and when he does, his check is insufficient to be an LP or even get him into an angel syndicate. As a result, he gives up. Ada, a young founder, on the other hand, is struggling to raise enough capital to keep her startup running. As a result, she closes the company.

But what if Ada could find tens, hundreds, or even thousands of Shola with only $100 or less to invest? She could have raised close to what she required to keep her company running. GetEquity was created as a result of this simple thought.

Investing in early-stage businesses is typically not a public affair; it is mostly available to capital institutions, top-tier individual angel investors, syndicates (groups of angel investors), and, on occasion, family and friends. Though this is still largely the case, startups such as GetEquity are making a concerted effort to disrupt this privileged arrangement and make the space available to anyone who is interested.

Startups can get instant access to a variety of angel investors, syndicates, and institutional investors through GetEquity. Startups will also be able to raise funds from their communities and customers, “giving ownership and a stronger sense of belonging to their most loyal customers.”

For example, Herconomy, a female-focused fintech startup, closed a $100,000 pre-seed funding round in less than 24 hours on the platform. That is 20% of the total funding raised and the portion set aside for the community. Previously, the possibility of a Nigerian startup closing a funding round—both seed and series—within 24 hours was not only a tall order, but also a fantasy.

Fluidcoins, TalentQL, and Mizala, on the other hand, have closed $30,000, $25,000, and $25,000 from users who were not necessarily part of their communities, respectively.

To dispel the myth that GetEquity was built on blockchain technology, the CEO stated that their technology only employs the core blockchain concept of tokenization. “Blockchain is all about ownership, accessibility, and security, and we borrowed this core concept to tokenize funding on our platform,” Dike explained.

This means that if a company wants to raise $50,000, it must sell 5,000 tokens at $10 each.

Investment security and due diligence

Due diligence (DD) is one of the most important and time-consuming stages of investment; it is at this point that a company’s worthiness is evaluated. At this stage, there are numerous checks and note comparisons. The question now is, if investors can’t conduct due diligence on their own, how do they know if a company is worth investing in?

Apparently, GetEquity works like any other VC: its team of diverse backgrounds—law, marketing, investment, and business development—assesses a startup’s potential growth before onboarding it on their platform. If this is the case, one may choose to call into question the validity of the disruption the company promises to bring to startup investment. Isn’t this just a digital venture capital firm? It is and it isn’t, to be sure. Unlike most traditional VCs, GetEquity’s DD process is said to be quick and does not bind startups to ridiculous equity stakes.

“We examine the entire business, including the model, product roadmap, founder(s), traction, and revenue.” “We ensure the business is solid before we enlist them on our platform,” said Printivo’s head of growth, Ekundayo, who also serves as co-CEO.

However, Ekundayo stated that, despite the company’s thorough approach to DD, the company cannot guarantee investors ROI on all of their investments. As a result, GetEquity accepts investments as low as $10; this allows investors to spread their money thinly across a number of startups, reducing risk.

Traction and Growth

In addition to the $100,000 GetEquity raised in April of this year, it also received an undisclosed six-figure pre-seed from Green House Capital, a renowned fintech investment firm based in Nigeria, proving the viability of its products. According to the co-founders, the company has grown at a 100 percent rate across all metrics since the investment. Its platform has over 4,000 users. Approximately 20 startups are currently listed on its platform, and over $400,000 has been invested in it.

GetEquity has launched a couple of features that make investing on its platform even more appealing; it has launched secondary markets where users can sell off their equity (token) based on its current value. For example, if a user wants to sell their token after buying and holding it for a while, they simply indicate their desire to sell and they will be matched with a buyer, and vice versa.

The startup also recently launched Dealroom, a feature that allows users, primarily syndicates, to privately raise money more quickly. Consider a private room where you can quickly meet with your family and persuade them to commit to a course, but in this case, the course is about raising money.

GetEquity provides a wallet infrastructure for users to hold value until they are ready to invest in their chosen startup. It charges between 0.5 and 5% on each transaction, depending on the payment method selected. Because of its partnership with Fluidcoin, another startup that has raised funds on its platform, there is also the option to fund a wallet with cryptocurrency for those who live in areas where crypto transactions are not frowned upon. In addition, startups are charged a 4 percent transaction commission.

Both domestic and international investors are bullish on Africa, particularly Nigeria, which received the most funding (approximately $1.4 billion) out of the nearly $5 billion raised by African startups in 2021. This trend is expected to continue for Nigeria in 2022, thanks to GetEquity’s more inclusive funding infrastructure.