How Fintech Can Build a Multi-Channel Digital Game Plan

Africa’s FinTech sector is growing fast, improving the continent’s financial landscape. The number of FinTech companies increased from 450 in 2020 to 1,263 by early 2024. This big jump shows how important the FinTech sector is in bringing new and better ways to manage money across the continent. Experts believe the sector could make $65 billion in revenue by 2030, which is almost seven times more than the $10 billion it made in 2023.

This fast growth is happening because more people are using digital tools, many are young and ready to try new things, and mobile phones are everywhere. As FinTech keeps rising, companies must find smart ways to reach and connect with their users. To do this, they need strong digital marketing plans that use many channels, like social media, emails, and websites. These tools help them stand out from the crowd and grow their business for the long term.

As a digital marketing professional who has worked in the digital marketing space for many years with different FinTech companies, I will show you how FinTechs can build and use strong multi-channel marketing plans. This will help to enhance their reach and impact in Africa’s rapidly growing financial technology ecosystem.

FinTech Marketing

Source: simpletiger

In the fast-paced world of FinTech, innovation is not enough. Even the smartest solution or sleekest app needs to be seen, trusted, and used. That’s where FinTech marketing comes in as the bridge between brilliant ideas and real-world impact.

FinTech marketing is not like traditional bank advertising. It must move faster, feel more personal, and educate as it engages. With a large portion of Africa’s population still new to formal financial tools, the right message in the right place builds trust, drives signups, and creates real change. According to McKinsey, Africa’s digital financial services revenue could grow by 10% annually if providers can scale adoption and retention.

With the increasing smartphone ownership and expanded internet coverage, leveraging multi-channel marketing becomes increasingly important. No single touchpoint works for everyone. A marketing professional in Lagos might discover a FinTech loan app through Instagram, while a market seller in Accra might respond better to a WhatsApp broadcast or a short explainer video shared through local networks.

To drive more growth, some of the most effective marketing channels for FinTechs in Africa include:

- Social Media (Instagram, X, TikTok): For brand awareness and engaging content.

- Search Engines: For visibility when people look for financial solutions.

- SMS and WhatsApp: For direct, cost-effective, and localised communication.

- Email: For onboarding, retention, and personalised updates.

- Influencer Partnerships: Especially with local voices who can break down trust barriers.

- Content Marketing: Blogs, videos, and explainers that educate users and answer questions.

Designing a Multi-channel Digital Strategy

Source: Writerzen

In Africa’s fast-growing FinTech space, having a strong multichannel digital marketing plan is key. It helps you build trust and grow your business over time. But to do it well, here are some important things to keep in mind:

- Understanding the Target Audience: Africa is home to many people. Some know a lot about money and tech, while others are still learning. FinTech marketers should group their audience by age, income, and how well they use digital tools. This helps them send the right message to the right people. When your message feels personal, more people will listen and take action.

- Start with the Bottom of the Funnel: Most FinTechs rush into awareness campaigns. Don’t start your strategy by chasing people who don’t even know they have a problem. But you should begin where the money is—at the bottom of the funnel. These are people actively looking for solutions like yours. They’ve done the research. They know the pain. They just need to see why you’re the best option. Targeting them first means higher conversions, faster feedback, and stronger ROI. Whether it’s paid search, remarketing, or direct response content, go for high-intent leads first.

- Choose the Right Channels for Scale: Every FinTech is different, but some channels are consistent winners:

- Google Search Ads— High-intent leads searching for keywords

- LinkedIn Ads— If you’re B2B or offer embedded finance products, LinkedIn gives you precision targeting by industry and role.

- Social media (TikTok, Instagram)— Great for B2C FinTechs that need to build trust and explain services simply.

- Email Marketing— Use for onboarding, upselling, and keeping users engaged.

- YouTube & Video Networks: Ideal for educational content—explainers, testimonials, product walkthroughs.

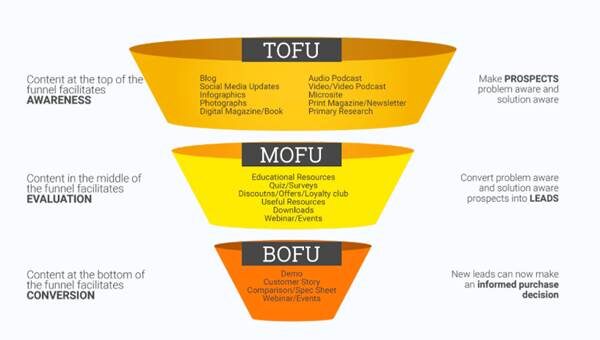

- Create the Right Type of Content: What you say is just as important as where you say it. Match your content type to the funnel stage:

- Bottom of Funnel— Product demos, free trials, customer reviews, strong CTAs. Help them take action.

- Middle of Funnel— Case studies, FAQs, webinars. Prove your credibility.

- Top of Funnel— Financial literacy blogs, explainers, short-form videos. Build awareness, only after you’ve nailed the lower funnel.

Also, remember, the video content is leading the charts. [5]87% of people say they’ve been convinced to buy a product or service by watching a brand’s video. Use it well.

Best Digital Marketing Channels for FinTech Growth

Some of the best digital marketing channels you can leverage to elevate your FinTech marketing game plan include;

- Pay-Per-Click (PPC): Great for capturing high-intent users at the bottom of the funnel. Use Google Ads to target keywords like “best savings app” or “quick loan.”

- Content Marketing: Teaching people through helpful content is a smart way to grow. Start with content that helps people in the bottom-of-the-funnel (BOFU), who are ready to take action. Once they trust you, share bigger topics to reach even more people.

- Search Engine Optimisation (SEO): To grow your business over time, people must find you online. If your website isn’t on the first page of search results, most people won’t click. Showing up early helps more people see what you offer—and that leads to more trust and growth.

- Email Marketing & Automation: Stay in touch with people who show interest. Send them useful tips, news about your product, and smart money advice that fits their needs. This helps keep them interested and ready to take action.

- Social media: Pick the right platform for your audience. Use LinkedIn if you’re selling to businesses (B2B). Use Instagram and TikTok if you’re selling to everyday people (B2C).

- Influencer Partnerships: In places like Nigeria, Kenya, and Ghana, influencers help people trust your brand quickly. Work with them to show what you do clearly and visually. This makes it easier for people to understand and believe in your value.

By starting with the right audience, FinTech digital marketers can grow faster, learn quicker, and build stronger campaigns that last.

How to Bring All Channels into One Strategy

According to Omnisend, marketers who use at least three channels in one campaign see a 287% higher purchase rate than those using just one channel. It’s not enough to be present on different platforms. The real magic happens when all your channels talk to each other in one unified, well-planned strategy. Start by building a single customer journey that connects every step, from awareness to action. You want a user who saw your TikTok ad to land on your website, sign up for your email list, get retargeted with Google ads, and eventually click to open an account. That’s how multi-channel works—not as separate pieces, but as one system.

Here are valuable tips to harness the power of all channels together.

1. Use One Message Across All Channels: Your brand voice, tone, and value proposition must be clear and consistent. If you’re promoting “zero fees” on your app, that promise should show up in your search ads, your blog posts, your Instagram stories, and even your email campaigns. Repetition builds trust.

2. Automate What You Can: Use tools like HubSpot, Mailchimp, or Customer.io to send the right messages at the right time. These tools help you stay connected with users without doing everything by hand.

3. Analyse and Optimise Constantly: Track every click, view, and conversion. If YouTube brings in more high-quality leads than Instagram, reallocate your budget. Your strategy should evolve with the data.

Wrap Up

Africa’s FinTech boom isn’t slowing down, and neither should your marketing. But growth without structure is noise. That’s why a multi-channel strategy isn’t just nice to have; it’s the edge your FinTech needs to cut through the clutter, connect with the right people, and convert interest into trust.

This is not about being everywhere. It’s about showing up intentionally—where your audience is, with content they care about, and at the exact moment they’re ready to act. Whether it’s a quick video on TikTok, a high-intent search ad, or a nurturing email, each channel has a role to play. And when they all work together? That’s when your marketing becomes unstoppable.

Writer: Uchechukwu Favour Nmesoma

Uchechukwu Favour Nmesoma is a visionary marketing leader, driving growth for top brands with her data-driven approach and innovative campaigns. With expertise spanning e-commerce, EdTech, entertainment, and FinTech, Favour has delivered remarkable results, including 40% conversion rate surges and 70% increases in email engagement.

Passionate about giving back, Favour volunteers her expertise to empower young African minds. A soon-to-be author, she’s dedicated to educating entrepreneurs about the transformative power of digital marketing. Favour continues to inspire others with her remarkable journey.