GIIG Africa Fund launches; to fuel SDG-driven innovation in Africa

Written by

Focussed on catalysing dramatic change via disruptive tech investments in emerging markets, the Global Innovation Initiative Group (GIIG), has announced the launch of a unique profit and purpose fund aimed at investing in early-stage tech innovation startups across Africa.

The GIIG Africa Fund, a Curaçao-based private investment fund, will invest annually in the winners pool from the African region of the Global Startup Awards (GSA), the worlds’ largest independent start-up ecosystem competition.

The aim: to stimulate entirely new industries, accelerate cross-border collaboration and unlock access to new markets across Africa.

As the exclusive rights holder for the Awards, GIIG Africa Fund will have access to an active pipeline throughout the African continent comprised of vetted participants across venture capital stages engaged in categories linked to the United Nations Sustainability Goals and megatrends of the 2020s.

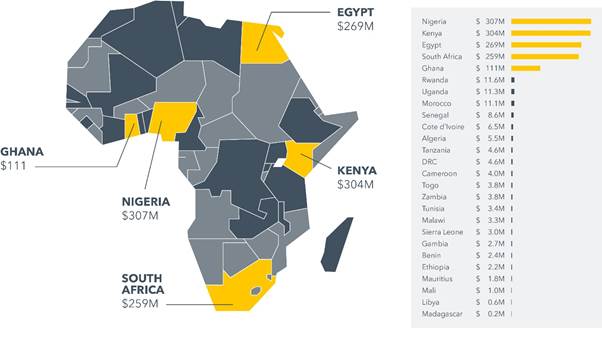

Image: Figure 1: Geographical Landscape – Africa, the Largest Free Trade Area in the World.

Venture Capital Funding is concentrated in a few markets, but with strong signs of diversification across half of the African countries, now in play. GIIG will play a pivotal role in scouting talent from all 55 African Member states to stimulate cross border collaboration.

Multi-stage capital will be combined with growth support, access to high value networks, and fast-tracked market penetration to optimise outcomes for both startups and investors.

To this end, GIIG Africa Fund will be collaborating with one of the largest accountancy firms in the world, Africa’s top business school and an investment committee with wide-ranging knowledge and experience across venture capital, tech innovation and African startup spaces.

Mahyar Makhzani, GIIG Founding partner, says: “We are not just launching a new fund, rather, this is the dawn of a new way of finding and funding startups in Africa since our candidates will have had to go through a vigorous competition and vetting process to be eligible for funding which means that they will be the cream of the crop, thereby increasing our investors’ chances of success.”

Open only to qualified investors, the Fund is seeking to raise $100m in capital commitments to invest in tech and innovation in Africa over the next three years, and is targeted to return over 25%.

“The GIIG Africa fund is geared at breaking open the funding landscape to provide access for innovators across Africa to a world class support team and significant global networks. For those with the drive and potential, this will be a game-changer for the top African tech disruptors,” says Caitlin Nash, GIIG founding Partner

“Our aim with the Fund is to create the impetus for smart investment in African tech startups; offering real investment options that will potentially lead to positive financial returns and lasting impact. Africa is an untapped market for investment in tech and innovation, with the continent’s propensity for leapfrogging representing a sound and potentially lucrative alternative to markets in South America and Asia,” adds Philip Baldwin, fellow GIIG founding Partner.

According to McKinsey & Company, Africa will be home to almost one-fifth of the world’s population by 2025, and by 2045 its cities will have more people living in them than in India and China combined.

This will escalate consumption on the continent, and coupled with the African Continental Free Trade Agreement, will produce an estimated $5.6 trillion in African business opportunities over the next few years.

“With this in mind, can investors afford to risk missing out on what has been hailed the greatest growth opportunity of the 21st century?” concludes GIIG Founding Partner, Jo Griffiths.