Flutterwave completes $250m Series D with valuation at over $3bn

Flutterwave, a Nigeria-based fintech company, has raised $250 million in Series D funding, its single-largest investment to date, valuing the company at more than $3 billion.

B Capital Group led the investment, which included new investors Alta Park Capital, Whale Rock Capital, and Lux Capital, as well as existing investors Glynn Capital, Avenir Growth, Tiger Global, Green Visor Capital, and Salesforce Ventures.

According to a company statement, the new funds will help Flutterwave’s ambitious expansion plan to accelerate customer acquisition in existing markets, growth through mergers and acquisitions (M&A), and the development of complementary products.

The San Francisco-based company, founded in 2016 in Nigeria, specializes in individual and merchant transfers, and is one of several fintech firms aiming to facilitate and capitalize on Africa’s booming payments market.

The San Francisco-based company, founded in 2016 in Nigeria, specializes in individual and merchant transfers, and is one of several fintech firms aiming to facilitate and capitalize on Africa’s booming payments market.

Flutterwave launched a number of new products in 2021, including Flutterwave Market, which allows merchants to sell their goods through an online marketplace, and Send, a remittance service that allows customers to send money to and from Africa.

To deliver financial services in Africa, Flutterwave has also partnered with leading global and pan-African technology and telecommunications companies such as PayPal, MTN, and Airtel Africa. Customers can also use the company’s APIs to create custom payment applications.

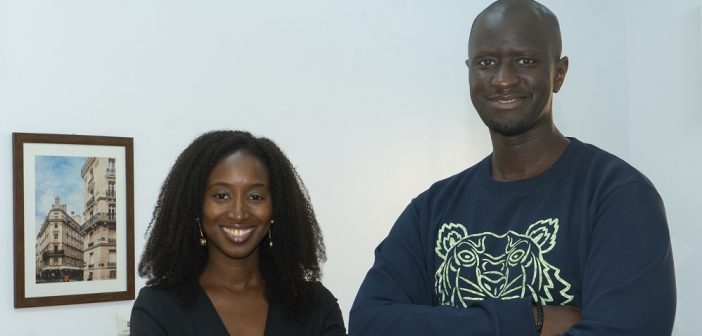

“We set out to build a platform that simplifies payments for everyone, and today, our solutions are used across the globe to connect Africans to the world,” said Flutterwave’s Founder and CEO, Olugbenga ‘GB’ Agboola. “This latest round of funding provides Flutterwave with much-needed support as we work to deliver on our plans to provide the best experience for our merchants and customers all over the world.”

The completion of the funding round, which comes more than two years after Flutterwave announced a partnership with Visa and Worldpay, demonstrates the growing interest in Africa’s burgeoning payments market.

The Series D funding comes on the heels of an impressive five-year run in which Flutterwave has processed over 200 million transactions worth over $16 billion across 34 African countries. It also comes after a year of rapid growth for the brand, which now serves over 900,000 businesses worldwide.

“As Flutterwave investors since 2017, we’ve had a front-row seat to see Flutterwave establish itself as a leading payments company in Africa as it drives adoption of seamless digital payments experiences for merchants and consumers alike,” said David Glynn, managing partner of Glynn Capital. “We look forward to assisting the company in addressing its significant growth opportunity in the coming years.”

Flutterwave is one of Africa’s most valuable unicorns (startups worth more than $1 billion). This latest round of funding more than triples the company’s valuation since its last funding round in March of last year.