Faith Meets Fintech: Wesley Bank Bets on Churches to Drive Digital Banking in Nigeria

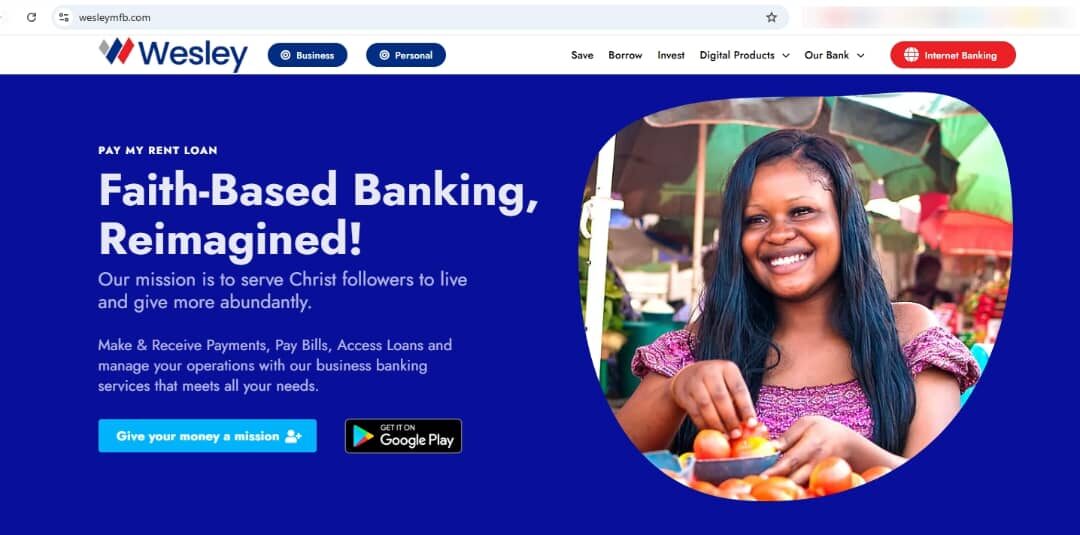

Nigeria’s crowded neobank market has a new entrant in Wesley Microfinance Bank, now repositioned as a digital bank aiming to redefine how churches, faith institutions, and their members access financial services.

Wesley launched its mobile app on the Google Play Store, aiming to serve a market few fintechs have tapped: churches and their communities. Wesley’s bet is simple: churches aren’t just spiritual hubs, they’re economic powerhouses. From schools and hospitals to thousands of staff members, they represent a vast financial ecosystem underserved by traditional banks.

“The launch of our app is just the beginning; our goal is to build the financial rails that help churches and their communities thrive, starting with consumer lending, but ultimately powering the entire faith-based economy said Oluwole Ogunlade, who played a major role in the successful launch of the Wesley project. Under his leadership as Managing Director, Wesley has undergone a full digital transformation, including securing regulatory approval from the Central Bank of Nigeria and designing a platform tailored to the unique financial needs of religious communities.

Wesley’s strategy goes beyond savings and consumer lending. The bank is exploring how faith institutions can leverage their structures to better support staff and members. This includes financing church-owned schools and hospitals, extending financial well-being tools to staff, and providing savings and lending products designed for congregation members.

Early reception of the app has been positive, with users praising its ease of use and accessibility. As Wesley scales, it aims to position itself as the financial backbone for faith institutions in Nigeria and across Africa, offering banking with values-driven impact. The banking portal can be accessed at www.wesleymfb.com