Exploring the African tech funding landscape for the “big four” in 2021

2021 was the best year on record for African tech startup funding, with more startups raising more money from more investors than in any previous year.

However, that capital is increasingly being directed toward the “big four” African markets of Nigeria, Egypt, South Africa, and Kenya.

According to the seventh edition of Disrupt Africa’s African Tech Startups Funding Report, which is available free to all as part of an open-sourcing initiative in partnership with Novastar Ventures, MFS Africa, Quona Capital, 4Di Capital, MEST Africa and Future Africa, 564 African tech startups raised a combined US$2,148,517,500 in 2021.

In terms of funded ventures and total secured capital, the ecosystem as a whole has seen incredible growth, while individual markets and verticals have also had banner years.

Nonetheless, investor attention is shifting to the major markets, which is perhaps unsurprising at this stage of the ecosystem’s development.

The dominant big four take the lion’s share, with Nigeria reigning supreme.

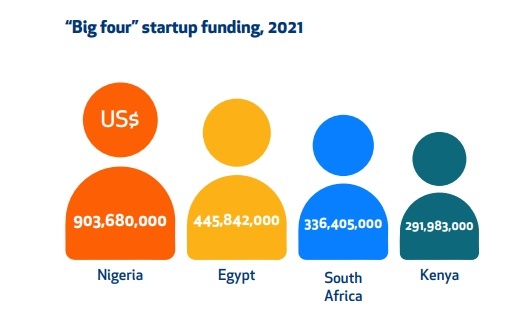

Investment in African startups may have increased significantly between now and 2021, but the majority of the benefits are being felt by a relatively small number of countries. Over the course of the year, Africa’s “big four” startup ecosystems – Nigeria, Egypt, South Africa, and Kenya – raked in a total of US$1,977,910,000, accounting for 92.1 percent of the total.

This is the continuation of a multi-year trend in which a larger share of funding is going to more established destinations. The “big four” secured 92.1 percent in 2021, up from 89.2 percent in 2020, 87.5 percent in 2019, and 79.4 percent in 2018. So, while funding is unquestionably increasing, it is becoming more concentrated. The “big four” also had a higher share of funded startups than in 2020, rising to 80.1 percent from 77.3 percent.

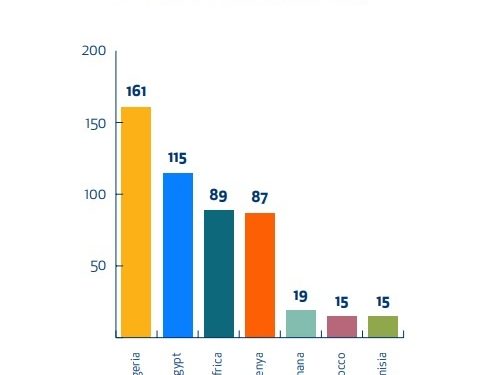

Nigeria was the standout performer among those four countries, leapfrogging all others to take the top spot in 2021. In total, 161 Nigerian startups raised a whopping US$903,680,000.

That total funding figure is up 501% from the previous year, when Nigeria ranked second on the continent with a total of US$150,358,000. No other country came close to Nigeria this year, and it accounts for a whopping 42.1% of total funding secured in Africa.

In Nigeria in 2021, there were a number of exceptional standout rounds that put previous records to shame. Flutterwave’s US$170 million round was the largest on the continent this year; TradeDepot contributed US$110 million to the total; Moove contributed US$63.2 million; Daystar Power US$62 million; Fairmoney US$42 million; Metro Africa Express US$31 million; and 54gene US$25 million – to name a few of the headliner rounds.

Nonetheless, there is progress elsewhere.

The fact that the majority of funded African ventures in 2020 came from just four countries does not imply that there was no increased activity elsewhere. Despite the fact that its share of total funding has decreased, the rest of the continent continues to benefit from a trickle down effect.

The non-big four countries contributed $170,607,500, or 7.9 percent of the total. More than 40% of that was secured by startups from Ghana, Morocco, and Tunisia, with the latter two having particularly successful years, while 64 startups from 17 other markets received funding.

These included many of the continent’s fastest growing startup funding destinations, with massive strides made by countries such as Zimbabwe, Uganda, Rwanda, and Ivory Coast, so there are certainly many reasons for pride and optimism. Meanwhile, Algeria’s single 2021 round was a US$30 million investment for transportation startup Yassir, ranking the North African country fifth on the continent in total funding raised!