Building Trust in Digital Financial Services: A Growth Strategy for African Fintechs

Millions of people trust financial institutions to help them manage their money, grow their investments, and protect their data. A study by Edelman Trust Barometer in 2024 has proven that trust in financial institutions has reached a new high point in most countries across Africa. Globally, local banks are said to be one of the most trusted sectors in financial institutions, beating out insurance, advisory, investment management, and cryptocurrency firms.

However, trust is a very fragile thing to handle, and complacency is not an option. After the 2008 financial crisis, banks and Fintechs faced a lot of challenges in restoring the confidence of the public. As financial services move online, trust remains one of the most vital pillars for building the African fintech market. With rising concerns over data privacy and other related economic issues, financial institutions must continue to bring new ideas to build trust and retain credibility with consumers.

Furthermore, Fintech executives must learn to prioritise transparency in communications, deliver personalised experiences, strengthen cybersecurity, and align their values to those of their consumers.

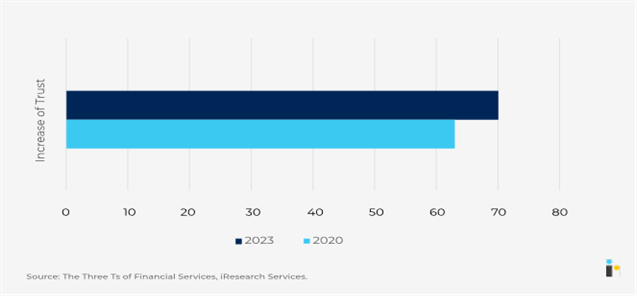

Despite these growing demands, consumers still maintain a more positive perspective on their financial relationships with Fintechs. iResearch Services in 2023 conducted a survey, and it revealed that 70% of the respondents believe their banks act in their best interest. This is an increase from 63% in 2020.

But trust here appears to vary by gender and age, with women and younger adults who took part in the research being less than the men and older cohorts to report trust in their banks.

Sources: The Three Ts of Financial Services, iResearch Services

Traditional banks are now also competing against a growing number of fintech companies to win customers and their trust. In a recent EY survey of more than 5,000 consumers, 37% of them identified fintech companies as their most trusted financial brand, while only 33% named a bank. Data protection came up as the highest-ranked trust factor.

Apart from data protection and privacy, trust is driven by different considerations, including brand legacy, innovation, customer experience, transparency, and environmental and social Governance (ESG). Various financial institutions bring their unique strengths and distinct approaches to build trust among their customers. For example, consumers still trust physical banks over online banking when it comes to managing complex financial products such as mortgages. Still, Fintechs succeeds when it comes to delivering tech-driven services with an emphasis on transparency and user experience, especially among more digitally inclined consumers.

For Fintech sectors, building digital trust, especially in the growing African market, is not a consideration but a strategic necessity. It has to do with creating an environment where customers feel safe and confident when transacting, sharing information, and utilising financial services. Building trust and maintaining confidence involves a combination of transparent communication and many more.

Let’s explore some of these strategies that will help financial institutions in Africa build trust and stay ahead of their competitors.

STRATEGIES TO BUILDING TRUST AND MAINTAINING CONFIDENCE

To secure long-term consumer trust in the financial institution, Fintechs must prioritise transparency, personalisation, security, and regular compliance with ethical standards.

- Transparency And Communication

The first step to take in building trust with your customers is to be transparent in all transactions and communicate concisely to keep your stakeholders updated. Most consumers feel banks could improve their communication by connecting with them on a more personal level.

Thought leadership is one of the effective ways Fintech can use to accomplish these two key points. Fintechs should merge informed perspectives with engaging storytelling techniques. Thought leadership can help financial services professionals align their positioning better and provide useful information to serve their customers better effectively and earn their trust.

- Personalise Customer Experiences

The truth is that people want to feel in control of their finances. Financial institutions can use a vast array of Artificial Intelligence (AI) and data analytics tools to provide services that will help people achieve this goal and develop their financial awareness. Revolut, for example, has made this part of its value proposition by leveraging AI to provide personalised insights into spending habits and customisable notifications for financial goals.

This approach will not only improve user engagement but will also build trust by showing that the company understands the needs of its customers.

- Advanced Cybersecurity Measures

Another approach to be adopted by financial sectors in Africa to build trust is to invest highly in well-advanced cybersecurity measures. This is not just to build confidence but also to stay ahead of competitors. With the increasing threats of cyberattacks, institutions in Africa today must adopt cutting-edge cyber resilience procedures to protect customers’ sensitive financial data. Beyond traditional methods such as end-to-end encryption and multifactor authentication, financial institutions can implement zero architectures, AI-powered threat detection systems, behavioural biometrics, and predictive analytics to help boost the security of customer data.

- Ensure Compliance with Regulations

Just like theGeneral Data Protection Regulation (GDPR) in Europe and The California Consumer Privacy Act (CCPA) in the United States, financial institutions in Africa must comply with ethical standards. This helps reassure consumers that their data, information, and finances are safe. But this goes beyond just compliance.

Source:https://www.iresearchservices.com/blog/building-trust-in-the-digital-age-how

Triodos Bank, headquartered in the Netherlands, for example, has shown how ethical banking practices can be a competitive advantage in the industry. Financial institutions here can incorporate this strategy as well because of their commitment to social and environmental responsibility.

Being ethically conscious has attracted lots of customers by simply adhering to high ethical standards, proving that compliance and ethics can go hand in hand with trust building in the financial technology market to boost productivity.

In conclusion, we must understand that a financial institution’s success depends on its ability to generate significant trust among its customers. They are, after all, asking those customers to commit their entire financial livelihoods to the institution. As these institutions’ digital offerings proliferate, so must their proactive efforts to build trust in their services.

Indeed, it is clear that institutions that prioritise building trust- by delivering personalised services, enhancing communication, investing in cybersecurity, and adhering to ethical banking services- will be best positioned to promote confidence in customers and build relationships that stretch over generations.

_________________________________________________

Kelechi Anyikude is a leader in digital and growth marketing dedicated to advancing financial inclusion through innovative solutions. With a strong background in payment technologies and a commitment to promoting inclusive finance, Kelechi frequently shares his perspectives on how technology intersects with financial services, providing straightforward and actionable strategies for enhancing digital innovation and improving access to financial options.