African Fintech Startup, Djamo Secures $14 Million to Penetrate new Markets

Djamo, a fintech firm in Francophone Africa building a personal finance business, has acquired $14 million in equity funding to continue building out a comprehensive range of financial services and to expand into new nations.

The fundraising round was co-led by Partech Africa, Oikocredit, and Enza Capital. Other current investors included Janngo Capital, P1 Ventures, Axian, Launch Africa, and others.

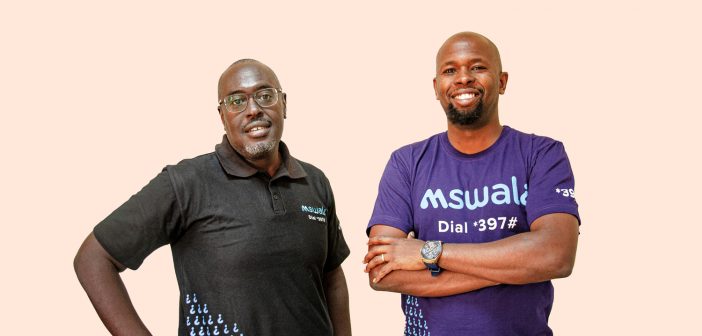

Regis Bamba and Hassan Bourgi, the two co-founders of Djamo, were inspired to start it because they wanted the hundreds of millions of residents of the region to have access to simple, mobile-first banking.

The fact that fewer than 25% of persons in West Africa have bank accounts makes the issue that Djamo is attempting to address evident.

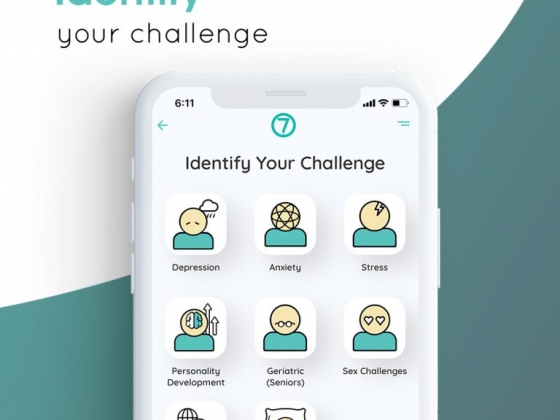

Djamo collaborates with neighborhood banks to offer a seamless mobile-first service without monthly fees or overdraft fees. A Visa card will be sent to you within two days of your account being opened.

The regulatory climate in Francophone Africa is more accommodating of innovation while protecting consumers, which has led to the emergence of numerous fintech companies there recently. The central bank now has a distinct department for fintech, illustrating how strongly they believe technology can change financial inclusion, according to Hassan Bourgi, co-founder and CEO of Djamo.

This fresh round of capital will allow the business to expand into new areas and finish offering its full complement of personal finance services, providing its clients more control and options in their financial lives.