Africa at the Forefront of Cryptocurrency Adoption in 2022: Full Report

Contents

- Crypto Adoption Globally and in Africa

- Crypto Adoption in Africa: The Opportunities

- Which Countries in Africa Are Using Cryptocurrency the Most?

- What Africans Do With Their Crypto: Use Cases

- Top Cryptocurrencies Traded by African Users

- Crypto Adoption Challenges in Africa

- Conclusion: How to Expand Crypto Adoption in African Regions

Crypto Adoption Globally and in Africa

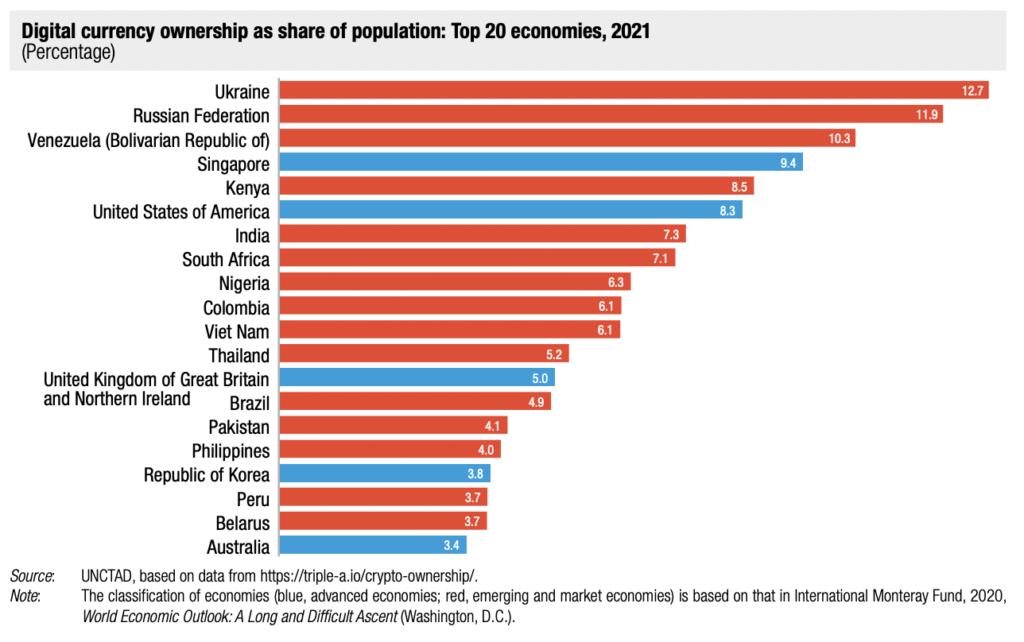

A policy brief by the United Nations Conference on Trade and Development (UNCTAD) highlights how the use of digital currencies soared through the COVID-19 pandemic worldwide. The impact was felt more intensely in developing economies, where consumers turned to cryptos as financial assets and enjoyed higher financial inclusion, despite their status as primarily unregulated.

The global pandemic brought considerable economic uncertainties – weakening of international currencies, the decline in GDPs, per capita income, and higher levels of unemployment due to lockdowns. Crypto assets gave many people worldwide an easy shot at making money – whether earning passive income or profiting from actively trading in the market.

Crypto adoption had a significant positive impact in emerging markets, where financial inclusion levels were relatively low. Digital currencies, decentralized finance (DeFi), and other avenues lowered the entry barrier, giving the young and tech-savvy population in emerging countries an easy way to hold, transfer, and earn from digital assets.

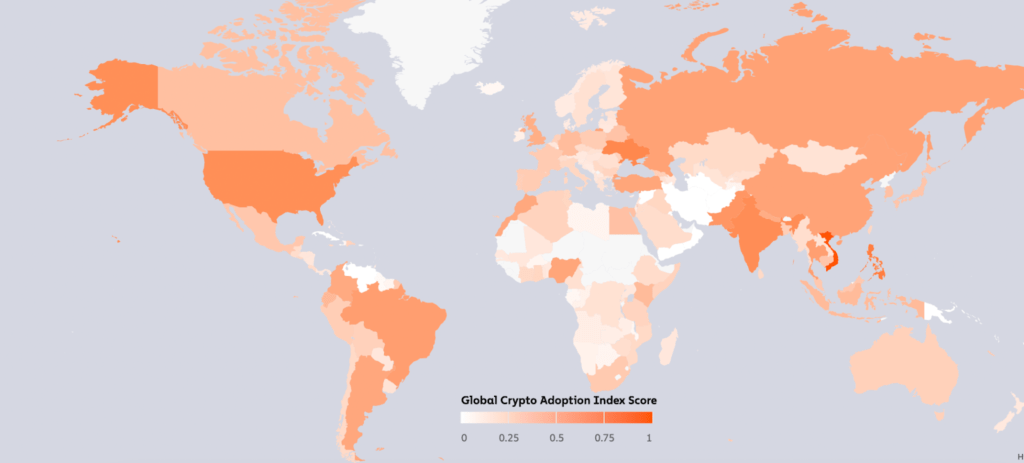

Africa is quickly emerging as the hub of global crypto adoption as the technology goes down from developed economies toward emerging markets. According to the 2022 Global Crypto Adoption Index by Chainalysis, three African nations are among the top 20 countries using cryptocurrencies and associated services – Nigeria, Morocco, and Kenya.

According to the UNCTAD report, 8.5% of citizens across Kenya held some form of digital currency – making it the highest in Africa in terms of crypto ownership and the fifth largest worldwide. Other African nations leading in digital currency ownership, as per data by UNCTAD, include South Africa (7.1%) and Nigeria (6.3%).

This report delves into crypto adoption across Africa – drivers, opportunities, and challenges. We’ll also look at the most crypto-savvy countries in Africa and the most popular crypto assets users like to trade or hold in this region.

Crypto Adoption in Africa: The Opportunities

Cryptocurrencies utilizing blockchain technology offer a decentralized, peer-to-peer, cryptographically secure way to transfer payments. Innovation in the blockchain industry in DeFi, NFTs, and GameFi has further driven up interest and pulled in more newbies, contributing to the mass adoption of digital assets worldwide, especially in critical regions like Africa.

Crypto adoption in Africa is set to grow shortly as its population offers several distinct advantages – educated, aware of cryptocurrencies and blockchain technology, and eager for innovative wealth-generating opportunities. This is a market rich in terms of the target audience for the crypto market.

Let’s take a look at some of the biggest reasons why cryptocurrency adoption is rising rapidly across Africa:

Rising Inflation

As discussed briefly in the section above, global inflation levels are soaring. Aggressive rate hikes by the US Federal Reserve and other leading central banks to offset the overheating of inflation have caused immense weakness in emerging market currencies.

African consumers have been dealt a double whammy as their purchasing power has declined. Their respective domestic currencies lose value against the US dollar even as prices of commodities and services rise. According to a report by the World Bank, staple food prices in the sub-Saharan African region soared by around 23.9% between 2020 and 2022 – the highest increase seen since the 2008-09 global financial crisis.

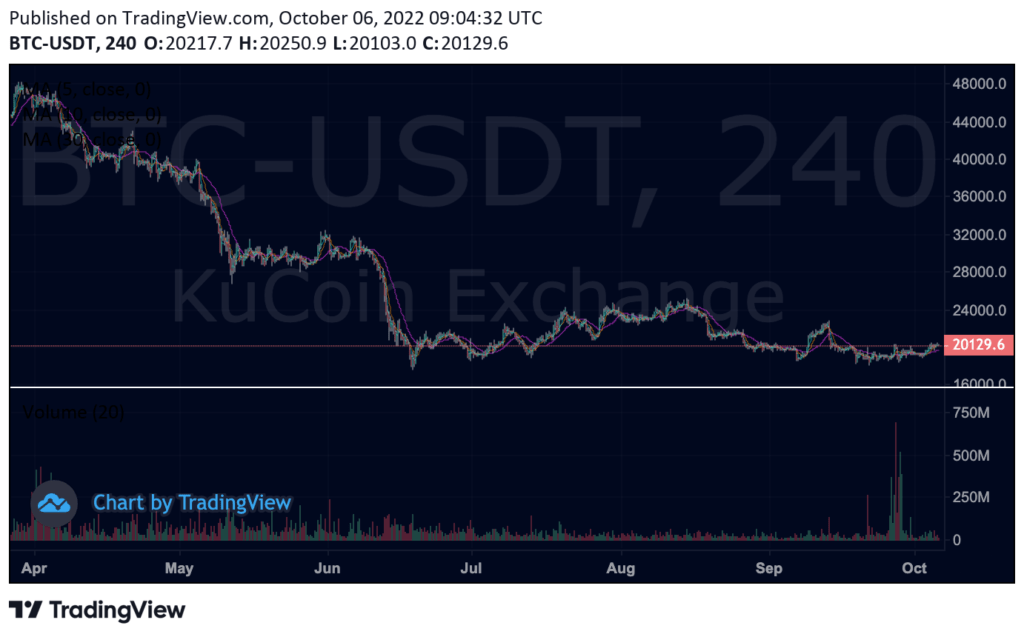

Against such a backdrop, several users in Africa and other developing countries could turn to invest in cryptocurrencies to protect against soaring inflation. The price of Bitcoin remains more or less stable, safeguarding against investor losses, unlike many traditional financial assets like equities and commodities that have experienced higher volatility lately.

Web3 Wave

The Web 3.0 movement ushers in a significant change in how consumers interact with online content. Web3 is powered by blockchain technology and cryptocurrencies.

Innovation in launching and adopting decentralized apps powered by blockchain could further take crypto into the mainstream. This, in turn, could drive higher growth in crypto adoption across Africa and global markets.

Drawbacks in Traditional Finance

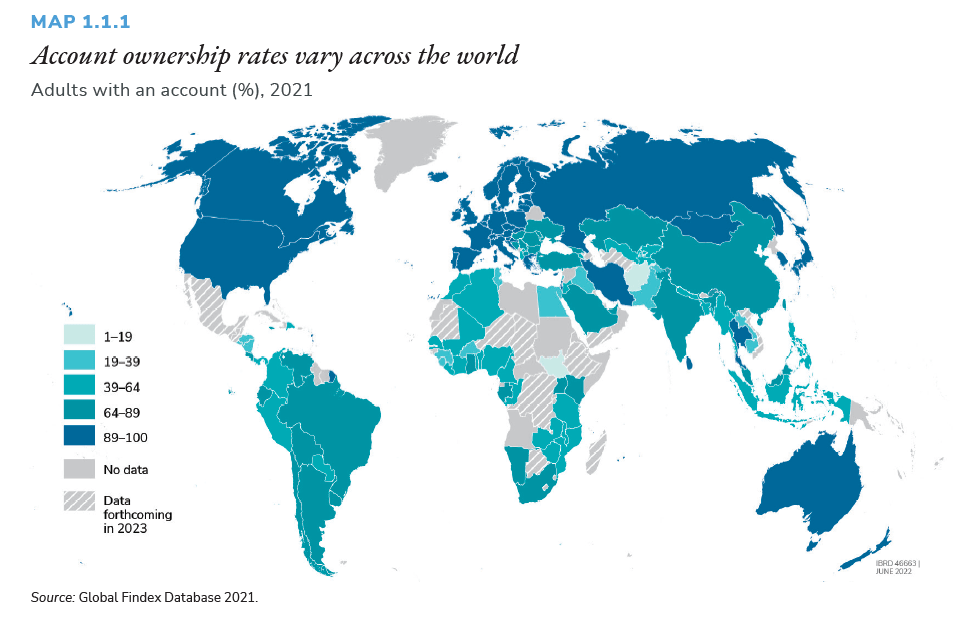

Traditional financial services like banks are highly regulated, and the stringent KYC norms make it difficult for a significant share of the population in developing countries to access such services. A high proportion of unbanked consumers in the African region have been kept away from the traditional banking and financial services industry for several reasons – lack of sufficient funds, illiteracy, inadequate identity verification, etc.

However, cryptocurrencies have lowered the entry barrier and made the unbanked feel more included in their market. Unlike opening a bank account, it’s easy for anyone to sign up and start buying and transacting using cryptocurrencies. The lower barriers have helped onboard several retail investors who lack access to traditional banking services. And this share of the population has experienced ease, convenience, and cost efficiencies in the decentralized space – several benefits the conventional industry cannot offer.

Weak Macroeconomic Conditions

The COVID-19 pandemic not only impacted the physical health of most of the population but also hit their financial health. In an emerging market like Africa, where most of the workforce lacks access to formal employment opportunities, the lockdown-driven layoffs harshly impacted earnings and savings.

Many savvy youngsters turned to trading cryptocurrencies which were going through a bullish phase during this period, from mid of 2020 through to the end of 2021. In addition to soaring trading volumes in the crypto market, decentralized finance services like staking and yield farming also gave many unemployed people an opportunity to generate earnings right from home. The next wave of crypto adoption among this segment came from NFTs and blockchain gaming, which threw open more streams of passive income generation.

With many African economies suffering fromweakness in their respective currencies while inflation levels started climbing higher and economic growth stalled through 2021, the need for an alternate store of value as a hedge against inflation further raised the appeal of cryptocurrencies in this market.

Cheaper Cross-Border Remittances

A significant population of Africans who work or live outside the continent sends money home to their families through cross-border payments. However, depending on traditional banks to remit payments back home is costly and time-consuming. While remittance inflows to sub-Saharan Africa increased by 14.1% from 2020 to 2021, research by Migration Data Portal indicates that average remittance costs touched a high of 7.8% during the period.

Cryptos allow emigrants to make low cost transactions quickly when sending payments back to Africa. As one of the biggest recipients of remittances worldwide, crypto adoption rose higher as a form of cheap and fast international payment transfer than the legacy infrastructure provided by traditional banking and financial services.

Innovation in Use Cases

Cryptocurrencies have come a long way from being a convenient way to make peer-to-peer transfers of payment. In the past couple of years, DeFi, Play-to-Earn, Move-to-Earn, NFTs, and the metaverse have brought in new ways to put crypto assets to work and even earn income from them.

The increased versatility of digital assets in recent years has made them even more attractive, further driving up their adoption. Africa is a young and tech-savvy continent, keen on adopting emerging technology. The higher internet penetration in key countries has increased the interconnectedness across the population, bridging the last gaps. The access to cheap and fast internet has also helped increase access to rapidly evolving innovations like cryptocurrencies.

Which Countries in Africa Are Using Cryptocurrency the Most?

Several research reports have examined and highlighted Africa’s growing crypto adoption levels. However, just like any other technology, the spread of cryptos is also somewhat uneven across the region.

Here’s a list of the most crypto-savvy countries, in terms of the number of crypto owners, across Africa:

- Kenya

- South Africa

- Nigeria

- Zimbabwe

- Ghana

What Africans Do With Their Crypto: Use Cases

Let’s explore some of the most common applications for cryptocurrencies among African crypto users. Here’s a list of the top use cases for crypto in Africa:

P2P Payments

The continent of Africa is home to several tech-savvy freelancers who accept payments from international clients using cryptocurrencies. Unlike remittances and other traditional forms of international money transfer, P2P payments in crypto can be made quickly and with meager transaction fees. 95% of all crypto transactions in sub-Saharan Africa consisted of individual transfers, as per a Chainalysis report.

In addition to being a popular way to accept digital payments among freelancers, crypto is also frequently used to transfer payments within the continent and by Africans working abroad who wish to send money back home to their families. There are also no stringent KYC norms holding back the use of crypto wallets and exchanges for financial transactions among young African consumers.

Cryptocurrency Trading

After digital money, the second most popular use case for cryptocurrencies in the African continent is crypto trading. Youngsters interested in trading the market spend some time ramping up their knowledge to perform technical and fundamental analyses.

Once they understand what influences market movements in the sector, they head to crypto exchanges to buy or sell digital assets against one another. Backed by research and training, crypto trading can be one of the most exciting ways to profit from investing in cryptocurrencies.

Mining/Cloud Mining

Several users in Africa also contribute to mining cryptocurrencies. While investing in mining rigs could be an expensive proposition for the more significant segment of crypto miners in Africa, cloud mining services significantly lowers the entry barrier.

Cloud mining offers users in Africa a convenient and affordable way to earn in cryptocurrency. Over time, they can increase their contribution of computing resources to generate more earnings from this activity. KuCoin has seen considerable levels of engagement for cloud mining services from users based in Nigeria.

Investing Via DeFi and CeFi Platforms

Crypto exchanges and DeFi protocols offer several attractive wealth-generating options that African crypto traders use. From liquidity mining to staking and yield farming, there are numerous opportunities to grow crypto holdings risk-free and conveniently.

Although the DeFi market has reduced in TVL considerably owing to bear market conditions, DeFi remains a popular option for young investors in Africa looking to put their cryptos to work and earn passive income from them.

Web3

Web 3.0 is the next most lucrative way to use and profit from cryptocurrencies across Africa. For instance, gaming dApps allow users to play and earn, while Move-to-Earn dApps offer rewards to incentivize fitness.

There are also several Web3 developers and content creators based in Africa who have made a career in this field. This is another highly profitable way to generate revenue from cryptocurrency services on the continent as they accept payments in crypto.

Top Cryptocurrencies Traded by African Users

We’ve looked at what drives cryptocurrency adoption across Africa, the opportunities cryptocurrencies offer, and the challenges holding back more widespread acceptance of digital currencies in the region. Let’s now take a look at some of the most preferred cryptocurrencies traded, used, and held by African consumers on KuCoin:

Bitcoin (BTC)

Unsurprisingly, the crypto king reigns supreme in the African market. The largest cryptocurrency by market cap is the most popular cryptocurrency invested by long-term holders.

Internationally, Bitcoin (BTC) is seen more as a store of value than a digital transaction method. The lower volatility in Bitcoin prices in recent months and its performance against the US dollar have increased confidence in BTC as an attractive inflation hedge.

Ethereum (ETH)

The second most popular cryptocurrency used across Africa is Ethereum (ETH). The native crypto asset of the leading dApps platform has made a remarkable uptick in trading volumes in the weeks leading up to The Merge – the transition of Ethereum blockchain from a Proof of Work (PoW) consensus to Proof of Stake (PoS).

Although its price experiences more fluctuations than Bitcoin’s, the lower Ether price makes it more attractive for crypto users in Africa who prefer to hold digital assets long-term. The more affordable yet highly liquid ETH is the second most popular crypto traded in Africa.

Ripple (XRP)

Several crypto enthusiasts in Africa continue to HODL XRP despite the ongoing legal woes between Ripple and the US SEC. The legal uncertainties have made Ripple (XRP) no less attractive as an asset to trade or invest in among African crypto users.

The low price of XRP makes it highly affordable for several crypto investors in the region, further increasing its preference among the numerous crypto assets in the market to date.

Litecoin (LTC)

Another classic among cryptocurrencies, Litecoin (LTC) offers an attractive store of value for several crypto HODLers across Africa. The Litecoin price is subject to lower volatility than Bitcoin and Ethereum, and it is far more affordable to invest in.

The fixed total supply of LTC also makes it a more affordable alternative to Bitcoin for African crypto users to buy and hold. Transferring cryptocurrency payments in Litecoin is also convenient as its blockchain charges lower transaction costs than many of its peers.

Cardano (ADA)

Charles Hoskinson’s creation Cardano (ADA) is another extremely popular cryptocurrency used across Africa. One of the key reasons behind this could be the Cardano Foundation’s dedicated focus on driving its blockchain technology adoption in the African region.

The ADA token is a preferred altcoin for Africa’s crypto traders to trade, hold, and invest in. There is also considerable interest in staking ADA to earn rewards.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is another popular crypto used for P2P payments in the African market. The low price and high liquidity make it a convenient crypto asset to hold and use for transferring payments decentralized and efficiently across the continent and globe.

Transacting using BCH is cheaper and faster than using BTC or ETH. It’s also popular as it is accepted as a payment option by leading businesses worldwide.

USD Coin (USDC)

Circle’s USD Coin (USDC) is also an extremely popular cryptocurrency used by African crypto enthusiasts. The stablecoin is an easy way to accept payments internationally.

In addition, it offers a convenient way to invest in the US dollar but via the crypto route. Several crypto investors prefer the US dollar and USD-backed stablecoins as an inflation hedge.

Crypto Adoption Challenges in Africa

Even though the opportunities for cryptocurrency adoption in Africa are aplenty, many key challenges are holding back mainstream acceptance of the asset class too. Let’s take a look at some of the pressing issues keeping people off crypto:

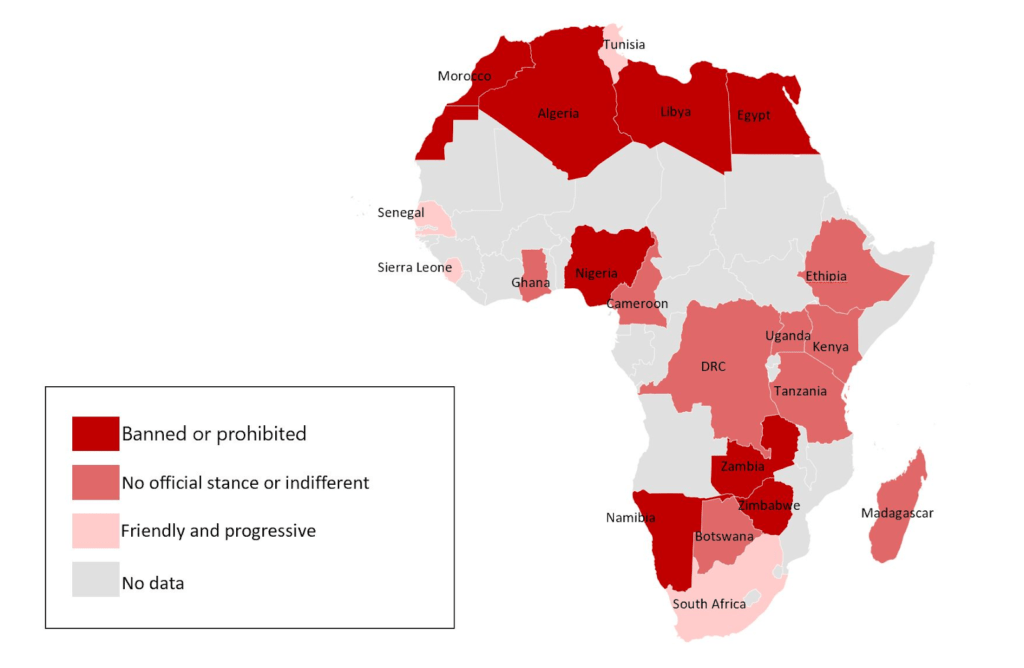

Regulatory Uncertainty

Like the world, the absence of cryptocurrency legislation and regulatory acceptance is probably the biggest drawback keeping consumers from adopting and using digital assets. For instance, the Central African Republic (CAR) announced that it would accept Bitcoin as a legal tender in April 2022, making it the first in Africa and the second globally. However, the enthusiasm among crypto supporters soon faded when the nation announced a freeze on this regulation and delayed its plans.

The CAR’s flip-flop on Bitcoin as legal tender is but one of many examples hindering investor confidence in crypto assets. The need of the hour is an enabling environment through international regulation that can be finalized and rolled out across developing economies across sub-Saharan Africa and the rest of the region. A move like this could help potential investors and businesses adopt cryptocurrencies more confidently and realize efficiencies.

High Volume But Low Value

While Africa is home to some of the fastest emerging markets in the world, e.g., South Africa, it is also a continent with several underdeveloped economies. The low per capita income relative to the developed world makes it hard for the crypto industry to take the African market seriously.

Although digital currency adoption across some African countries features among the top 20 in the world, the amount remains extremely low in terms of transaction volumes. A cryptocurrency report by Chainalysis reveals that total crypto transaction volumes across Africa between July 2021 and June 2022 came to around $100.6 billion. While the number of cryptocurrency transactions may seem high, it makes up only 2% of the global crypto activity.

Internet Speed

The world of Web 3.0 built on the blockchain data platform requires a good quality internet connection. Spotty internet connectivity and low network speeds impede crypto consumers from partaking in many lucrative opportunities to earn from cryptos.

A reliable internet connection could help many crypto-savvy African users trade the markets faster, play more Play-to-Earn (P2E) games, and experience the metaverse. Developed economies worldwide and some nations in the continent are moving to 5G, but it could take longer for the next-gen mobile network to fully roll out across the African market.

Conclusion: How to Expand Crypto Adoption in African Regions

After years of operating on the fringes, past events have reinforced the immense potential of digital currencies to transform how the world banks and uses money. Mainstream adoption of cryptocurrencies is already underway, not just in the developed world but also in developing economies. The technological innovation behind digital currencies have the power to bridge the gap between these two markets and bring more interconnected operations in global finance and banking.

In Africa, too, cryptocurrency has the potential to empower a large percentage of the population and help them bank, transact, and interact with anyone located anywhere in the world. However, nations need to formalize and implement a regulatory framework to manage cryptocurrencies and prevent fraud from scaling up cryptocurrency adoption. While regulatory requirements remain the foremost challenge, withholding crypto adoption anywhere in the world is especially vital in an emerging market like Africa, where interest is high but financial literacy levels are low.

Some countries are exploring the implementation of a cryptocurrency tax, to make the most of this emerging opportunity and as a way to regulate the sector. Many countries are exploring the use of central bank digital currencies (CBDCs) as a way to legalize and accept digital currencies.

Additionally, there is a need for better infrastructure to support crypto and blockchain technology, starting with reliable internet connectivity. Increasing internet penetration and performance could further bolster activity in the African crypto market.

Finally, there is the need for dedicated efforts by crypto and blockchain businesses to foster innovation and adoption of the technology by individuals, businesses, governments, and other establishments. Such a move will further improve the public’s perception of crypto as a capable financial asset class.