Anchor, Nigerian Banking-as-a-service Startup Secure $1m Pre-seed Round

Nigeria’s Anchor has acquired over US$1 million in pre-seed funding and announced the opening of its public beta. Anchor is a banking-as-a-service (BaaS) platform that enables the seamless development of financial products across Africa.

Olamide Sobowale, Segun Adeyemi, and Gbekeloluwa Olufotebi founded Anchor, which offers APIs for offering accounts, money movement, savings, and card goods. Segun Adeyemi was the former CEO of Amplifypay.

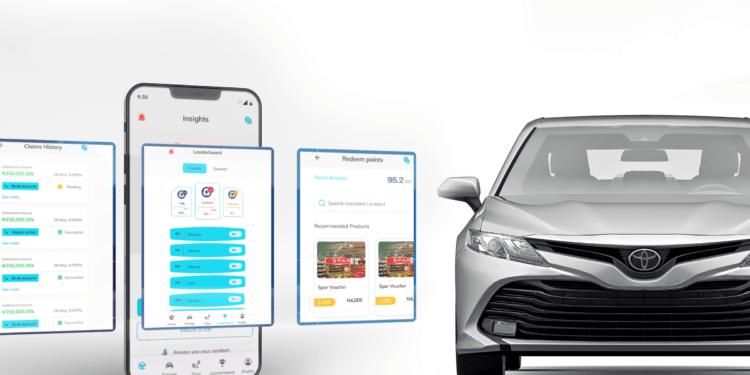

Starting in its first market, Nigeria, the startup’s recently released public beta API architecture makes it simpler for African firms to design, embed, and launch financial solutions.

Adeyemi stated, “We created Anchor to abstract away the difficulties in establishing financial products, so firms can get up and running in five minutes with just a few lines of code.”

The firm has now earned more than US$1 million in pre-seed capital to help it scale its product. It is now a member of the Y Combinator S22 batch. Along with a number of other investors, including Emmanuel Okeleji, Ado Oseragbaje, Yinka Odeleye, and Sanmi Famuyide, YC is one of them. Other investors include Byld Ventures, Luno Expeditions, Niche Capital, Mountain Peak Capital, and Byld Ventures.

Since its May beta launch, Anchor’s BaaS platform has already processed millions of dollars in transactions, increasing by over 200% month over month. Now it is opening its public beta to enable African businesses to integrate finance into their offerings and fintechs to create banking solutions. More than 40 other firms are already on the company’s queue.

“We have personally witnessed the arduous process of terminating banking alliances, negotiating third-party agreements, and securing regulatory permissions. Additionally, Adeyemi mentioned the protracted time and effort needed to provide financial goods.

“Regardless of the unique value propositions, companies shouldn’t have to wait years and spend millions of dollars to go-to-market due to the commonality in the underlying infrastructure. Because of this, we are eager for our public beta launch to put Anchor in the hands of many more companies.

A partner at Y Combinator named Ashutosh Desai expressed his excitement to support Anchor’s team in creating the financial infrastructure required for the continent of Africa’s economic development.

“Technology businesses in Africa can design products that can quickly increase access to and the quality of financial services thanks to Anchor’s embedded finance platform,” he said.

Youcef Oudjidane, the founder of Byld Ventures, stated his opinion that BaaS would be crucial to the dissemination of financial services throughout Africa.

As a full-stack BaaS provider, Anchor distinguishes between customer engagement and infrastructure, allowing its clients to concentrate on creating distinction rather than commodity infrastructure. We are incredibly thrilled to be working with this tenacious and knowledgeable team,” he declared.