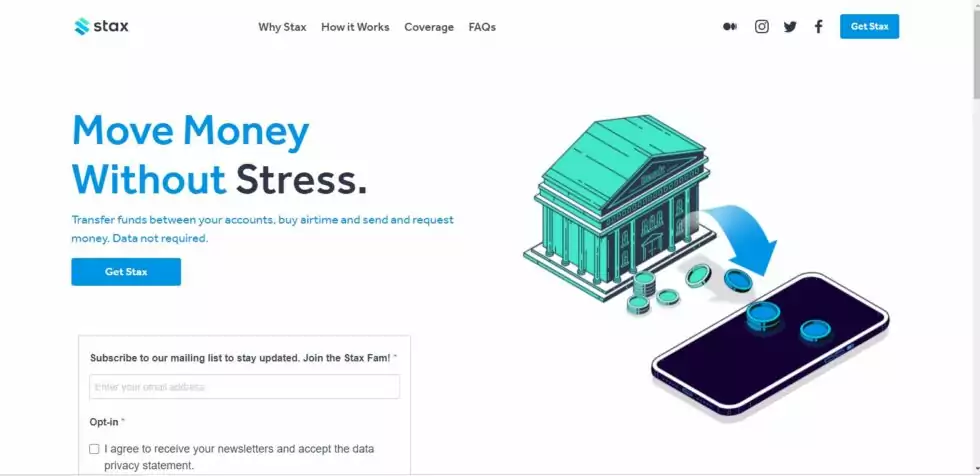

Stax is bridging the gap between USSD and bank apps

Stax is a firm that moves banking with Unstructured Supplementary Service Data (USSD) from the phone dialer to an offline mobile application, improving the user experience of offline banking.

According to Stax’s blog, USSD has been around for 24 years and is largely utilized by telecoms to let them communicate with their clients. Telcos, for example, have a USSD code that often begins with * and ends with # to check airtime balance or purchase data.

According to the Global System for Mobile Communications Association (GSMA), USSD is used in nine out of ten mobile money transactions in Sub-Saharan Africa.

Surprisingly, the technology is the result of engineers at the European Telecommunications Standards Institute (ETSI), an organization established by the European Union in 1988 to harmonise and standardize communication technology across Europe.

According to a Quartz Africa report from 2018, the document included a protocol intended to enable communication between telcos and their subscribers. However, telcos required a protocol and began machine-to-machine communication, in which the subscriber’s mobile phone would simply ask the network and receive an instant response.

USSD has evolved beyond assisting network and subscriber communication to being utilized for a variety of other applications, including banking. Surprisingly, the USSD protocol has not received a major improvement since its inception.

What distinguishes Stax’s use of USSD?

Stax is standardizing USSDs and making them easier to use. Instead of dialing *123# and following the instructions to pay money or buy airtime, Stax is centralizing all USSD codes.

It accomplishes this through the use of a USSD software, which automates transactions and saves you the burden of remembering codes and entering data into dialogue boxes as quickly as possible so that you do not receive an error message.

Stax Co-founder and CEO Ben Lyon highlighted on a teleconference with Techpoint Africa that the startup is trying to improve USSD and “find a way to provide smartphone consumers a means to harness the best features of USSD.”

The best thing about USSD, according to Lyon, is that it works offline; the worst thing about it, however, is that it has a terrible user experience.

USSD works with the dialer on a smartphone or basic feature phone. To conduct a bank transaction, for example, dial the bank’s USSD code and follow the directions in the interactive menus of the pop-up.

Because these menus are timed, inputting data such as an account number or personal identification number (PIN) must be done quickly or you will receive an error warning and have to restart.

Since the Internet assumed its position in industrialized countries, there has never been major advancement in the area of USSD. Because to the widespread use of the Internet and the rapid development of smartphones and computers, USSD has become obsolete.

In Africa, however, internet penetration is modest. Internet penetration among adults in the United States was 52 percent in 2000, substantially higher than Africa’s 0.5 percent.

While wealthy countries did not require USSD, it was critical in Africa, and it evolved from a means for telecoms to communicate with clients to a vital tool for financial inclusion.

Using USSD on smartphones with ease

“Is there a method for us to screen scrape USSD?” That was the query that laid the groundwork for what Stax is doing today: navigating USSD menus on behalf of end-users in the background of an Android app.

According to Lyon, the startup began by offering the solution to other developers under the moniker Hover, the parent company of Stax.

The business strategy, however, did not provide the expected revenue, and Stax was founded in 2020 as a consumer-facing version of Hover.

Lyon characterized Stax as an online payment mega software for Africa that centralizes all USSD-based services.

How does Stax function?

When using a phone dialer to access USSD, you may encounter a session error if you do not type quickly enough. Stax runs the USSD in the background and reduces the number of taps required to access the USSD menus within the app.

The Stax app functions virtually like to a bank app, but it is only available offline. It requires fewer information than bank apps, which makes it simple to set up. However, it requires authorization to manage phone calls and access messages.

Selecting your bank completes the setup process (s). Stax allows you to send money in just a few taps by selecting the sending and receiving banks as well as the amount to transfer.

When the app asks which SIM card you want to use to continue the transaction, it’s clear that it’s using the USSD protocol. Aside from that, the process is as simple as using an internet banking app.

“I liken USSD to the early days of the Internet,” Lyon remarked. “It’s like asking users to interact with the web without using a browser, by going directly to IP addresses rather than websites.”

With Stax improving the USSD user experience on smartphones, its market is limited to smartphone users, although Lyon claims that this is still a sizable amount.

While one may expect smartphone users to favor Internet transactions over USSD, data from the GSMA shows that, while smartphones outnumber feature phones in Sub-Saharan Africa, USSD remains the most popular means of banking.

In 2019, there were one billion mobile money accounts in Sub-Saharan Africa, with daily transactions totaling more than $1.9 billion.

How does Stax make money?

Stax is free to use and only charges a USSD telco session fee. As a result, it is difficult to discern how the corporation profits from its solution.

Lyon revealed Stax’s revenue generation approach, saying, “We’re going to start monetising in Kenya in the coming weeks.” Businesses who sell to our users will be charged fees and commissions. So, when you buy airtime through Stax, we’ll receive a small commission from the supplier.”

He went on to say that telecoms collaborate with dealers and distributors who buy wholesale airtime rates and sell them to consumers. Stax’s strategy is to collaborate with these distributors and direct traffic to them while taking a percentage.

Stax has a monetisation plan, but its viability can only be shown when it begins. Lyon added the startup just received a $2.2 million venture funding lead by World Within Ventures and Noemis Ventures in March 2022, which has been essential in the company’s growth.

Stax’s proposal extends beyond improving existing services available via USSD; it intends to make crypto services, among other things, available via USSD.

Will a technology that is 24 years old continue to dominate in Africa? Time will tell.