How Nigerian startups are maximizing biometric technologies

Biometrics are increasingly being used in corporate and governmental security systems, as well as consumer devices.

According to Research and Markets, a market research firm based in the United States, the global biometrics market is expected to grow from $17 billion in 2018 to $76 billion by 2027.

For a variety of reasons, an increasing number of Nigerian employers are also shifting away from traditional security and access control solutions and toward biometric solutions. Biometrics is being used by many government institutions and businesses in Nigeria to solve a variety of business problems.

What exactly are biometrics?

For biometric authentication, fingerprints, hand geometry, eye pattern, and face shape are all commonly used.

Biometrics enables each person to be identified uniquely based on physical or behavioral characteristics. This technology can be used to identify people who are being watched.

Employers use biometric technologies to improve the efficiency of their authentication process. Because of the physical parameters involved in identifying people, biometrics provide a more robust, sophisticated level of security, access control, and management than traditional counterparts.

Biometric technology adoption in Nigeria

According to a survey conducted by Comparitech, an online platform that conducts tech research, the collection and use of biometric data is widespread and intrusive in Nigeria. The study looks at biometric data collection in 96 of the world’s top 100 economies by GDP (GDP).

Nigeria ranks ninth in terms of biometric data collection, storage, and use.

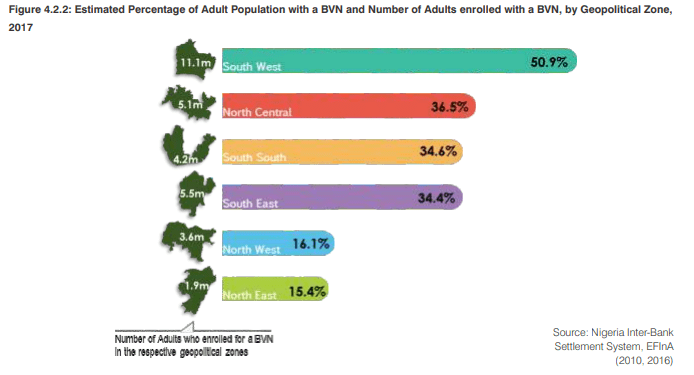

Over time, an increasing number of Nigerian public institutions have developed electronic means of delivering services and information to citizens, such as websites, emails, payment portals, and so on. In addition, the government uses biometric technology in civil service reforms to routinely remove ghost workers from the payroll. The National Identity Management Commission’s ongoing identity registration, the Bank Verification Number exercise, SIM card registration, and the Independent National Electoral Commission Voters Register are all based on biometric technology.

Nigerian banks and the Central Bank of Nigeria (CBN) also use biometric technologies to identify bank customers, such as fingerprints and face recognition.

Every customer is given a one-of-a-kind number known as a Bank Verification Number (BVN), which is used to verify all individuals with bank accounts and thus authenticate the customer’s identity.

While biometric security systems are widely used in governmental institutions and banks, the concept of biometrics may appear to be too technologically sophisticated for small businesses in Nigeria.

According to a recent survey I conducted in Nigeria, 90 percent of the 30 small businesses polled do not currently use biometrics for security and business purposes such as employee access and data security. In the coming years, 30% plan to at least consider implementing biometrics.

In reality, while the majority of small business owners believe biometric authentication is more secure than passwords, PINs, and personal security questions, according to the results of my poll, only 42% believe biometrics are secure enough to be used as the sole method of authentication.

While 37% of the 21 employees polled believe biometrics are effective at protecting data and securing identity data on-premises, they are not fully sold on the technology. Biometrics are acceptable to 45% of respondents, but the remaining 18% are concerned that it will infringe on their privacy.

Furthermore, despite significant progress in the use of biometrics in Nigeria, the survey results show that Lagos and Abuja have the best biometric data collection and utilization practices.

There are some disadvantages to biometric technology.

The use of biometrics in Nigeria has resulted in two major issues: user security and privacy. Collecting and utilizing data related to specific physical attributes is a significant step for both small business owners and customers.

Simply put, data privacy is easily jeopardized, according to David Ilemona, the founder and CEO of Danibe Farms, an agricultural startup based in Niger State. “What if a determined individual discovers people’s personal information and takes advantage of the system?” Leaking personal information about customers is a major concern for small businesses like mine.”

Cybercriminals have been known to develop innovative methods around employees’ information on occasion, according to Eze Hanson Obasi, an IT expert in Nigeria. According to Obasi, some of the challenges to startups in Nigeria adopting biometric authentication are cost, reliability issues, system update requirements, and concerns about the storage and management of biometric data.

According to Obasi, many business owners are skeptical of biometrics as a secure and reliable replacement for the traditional login and password combination. “For example, many Nigerians already believe that biometric-enabled e-governance is a means for the government to violate citizens’ rights, and that it is linked to victimization, persecution, and exclusion,” Obasi said.

However, Olawale Adeyina, Team Lead of TechCity, Nigeria’s first tech blog, believes that the cybersecurity risks associated with biometric technology can be mitigated through the use of multifactor authentication.

Concerns about human rights have also been raised, particularly when governments use biometric data for profiling and mass surveillance. Many people believe that Nigerian government agencies collect and process personal data in violation of data protection laws, with inadequate oversight and recourse.

“We hear about data privacy laws and procedures in the use of acquired data,” says Shedrack Muazu, Team Lead of Youths in Justice, Health, and Sustainable Social Inclusion (YIJHSSI), “but I doubt that implementation is effective.”

Should biometric technologies be used by Nigerian startups?

It’s up for debate. Do the benefits outweigh the costs and security concerns?

Despite the inherent security issues, biometrics are beneficial to Nigerian startups. For example, many Nigerian businesses are already investigating the use of facial recognition CCTV and finger-vein scanners for employee authentication. In fact, fingerprint scanners are not only less expensive and more widely available than facial recognition CCTVs, voice-based recognition, physiological recognition, and typing pattern recognition, but they can also be found on many smartphone devices.

With startup owners suffering losses as a result of time theft, investing in biometrics offers a very favorable return.

“When I worked at a fintech, we used fingerprints to clock in and out,” says Abayomi Michael, a former employee of a Lagos-based financial services firm. “Not everyone could advance into the business’s restricted areas.”

Michael believes that if employees believe there is a mechanism in place to track what they accomplish at work, they will be more accountable. “Biometrics may be a key component of ensuring a sense of control for startup owners who want to develop strong businesses,” he said.

“It is a high-priority change,” Obasi says. Biometric technologies should not be rushed into use by Nigerian startups, in my opinion. Instead, they should learn everything they can about this technology and figure out how to make it accessible and useful to them without jeopardizing employee or customer privacy.”

“Overall,” Obasi concluded, “whether you are a small business with five employees, a retail store, or a large corporation, biometrics will most likely provide your organization with a viable security solution.”