Is public shaming by online lending platforms legal or criminal?- A legal perspective

Is public shaming by online lending platforms that gives loan a legal or criminal?- A legal perspective

Written by Ejike Kanife

Nigeria is a country with millions of people existing in abject lack. With an unemployment rate of 33.3%, the country has the second-highest rate on the global ranking. According to a Bloomberg report, about 23.5 million of the 69.7 million-strong labour force in Africa’s most-populous nation don’t have meaningful jobs.

Another 15.9 million are underemployed which means they don’t earn enough from their jobs to make ends meet. Therefore, there are about 40 million people of working age, many of them with dependents, who are struggling to survive amid the economic hardship.

Basically, a majority will always need some extra money to live well.

This is where loan apps and micro-lending companies come in. By providing instant and collateral-less loans with zero documentation and low-interest rates, these online lenders that are sprouting everywhere are quickly replacing traditional banks as the source of easily accessible cash.

Herein lies the problem. The lack of collateral and proper documentation leaves the lending companies with little leverage for recovering their funds if the borrower defaults. Sadly, this has become the biggest problem loan apps have to deal with. And when dialogue fails, the companies find themselves left with no other option than to go to the extreme.

According to a staff of one of these loan companies who spoke with me on condition of anonymity, Nigerians are not creditworthy and sometimes the only way to get their money back is by resorting to really unconventional and sometimes extreme measures.

Basically, many loan apps seem to adopt a policy of harassment in their bid to get their money back.

And these unconventional measures could bother on privacy invasion and as many ‘victims’ have said, defamation and character assassination. This was the case with Soko Loans, a digital lending company that was recently slammed an N10 million fine by Nigeria’s digital regulator, the National Information Technology Development Agency (NITDA),

I spoke with a Business Law Expert, Chinenye Ajayi about what makes these measures legal or otherwise, what customers who ‘fall victim’ can do, and other measures which loan apps could employ so as not to run foul of the law.

Everyone has a right to privacy but…

On the issue of privacy invasion and the legality of the strategy of harassment employed by loan apps, Chinenye says every individual has a right to privacy which is protected by section 37 of the 1999 Constitution (as amended).

This right is also enshrined in the Nigeria Data Protection Regulation, NDPR (2019) which safeguards the right of a person to data privacy.

However, this right can be waived by the individual entitled to the said rights. According to her, this is usually what loan apps make their customers do.

“The terms and conditions are so widely couched that the loan applicant practically waives all right to claim damages or sue for liability in relation to any action taken by the lender to recover the funds,” she said.

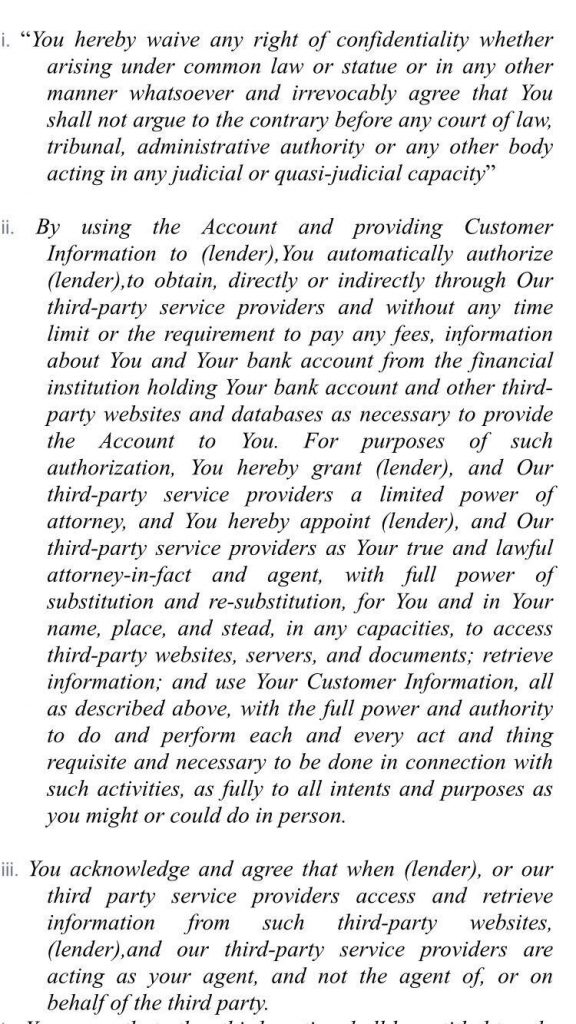

One of the conditions obtained from a loan app reads:

You hereby waive any right of confidentiality whether arising under common law or statute or in any other manner whatsoever and irrevocably agree that You shall not argue to the contrary before any court of law, tribunal, administrative authority or any other body acting in any judicial or quasi-judicial capacity.

The NDPR also acknowledges that a Data Subject (loan applicant) can consent to the processing of his or her personal data for one or more specific purposes as long as it is obtained without fraud, coercion or undue influence.

It also provides that the specific purpose for using the data must be made known to the loanee.

“Where the loan applicants have by agreement, expressly or impliedly, granted access to their private contact details, then it is arguable that the lender’s act of contacting families and friends is not in contravention of the law,” she said.

Do loan providers have the right to harass defaulters?

Going by the above explanation, one might conclude that loan apps are well within their rights to process and employ user data however they wish. But the Business Law Expert says that isn’t necessarily the case.

This is because loan apps mostly default in the very important provision of making the specific purpose of data processing known to the users.

In this case, users aren’t specifically told that their contact details would be exploited for the purpose of contacting their friends and families if they default on repayment.

This is based on Paragraph 2.3 (2)(b) of the NDPR which provides that in procuring consent, if the Data Subject’s consent is given in the context of a written declaration which also concerns other matters, the request for consent shall be presented in a manner which is clearly distinguishable from the other matters, in an intelligible and easily accessible form, using clear and plain language. Any part of such a declaration which constitutes an infringement of this Regulation shall not be binding on the Data Subject

Thus, to satisfy this vital provision of the NDPR, it is not enough for the loan apps to say that “we have a right to all your information on third party websites”. The terms and conditions must state particularly and expressly what type of information will be obtained and what that information will be used for.

“Consequently, sending messages to contacts of the applicant can be considered as an invasion of privacy if the loan applicant does not expressly consent to the specific use of that information in the manner it was used. The widely couched clauses can arguably be regarded as misrepresentation of facts as it is not specific. On this basis, the loan applicant may institute an action for an infringement of his or her right to privacy,” she said.

On the question of derogatory messages

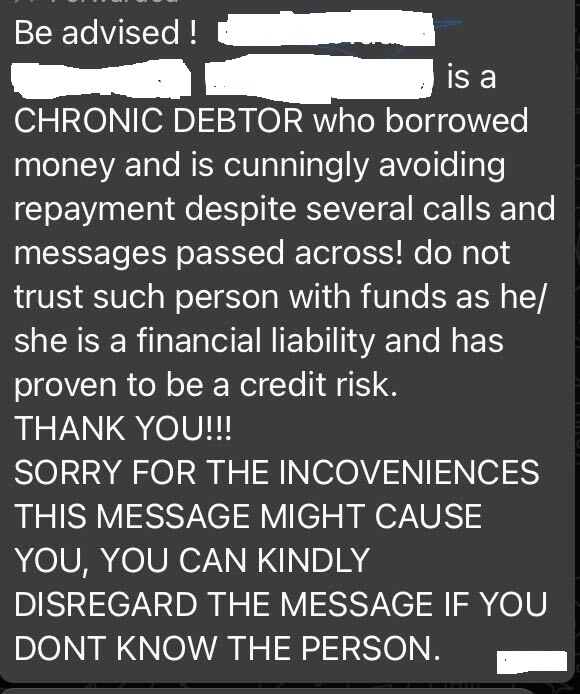

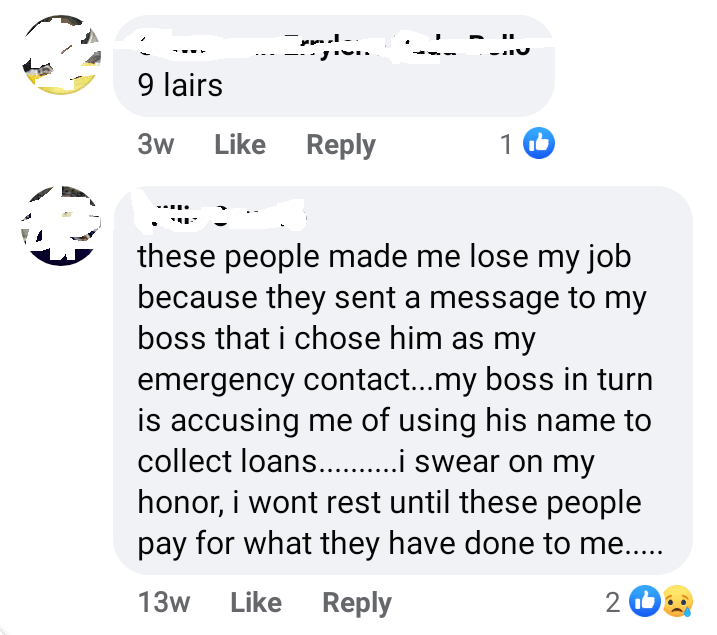

The problem doesn’t end with accessing users’ contact lists and sending messages to their friends and families. There’s also a problem with the nature of the messages sent.

These messages usually describe the defaulters in very strong negative terms like credit risk, chronic debtor, manipulator, liar, financial liability, etc.

This is usually embarrassing, both to the loan applicant and the people contacted. Some have argued that this is character assassination and defamation.

Is this really tantamount to defamation and would a defaulter be right to sue for damages?

Barr. Chinenye reiterated that it is one thing for loan applicants to grant the lender access to their contact list and it is another thing for the lenders to use the information for the purpose for which it was collected.

The vital question thus is: Did the loan applicants with full knowledge, expressly consent to the use of strong negative language in such a way as to tarnish their image?

“In the absence of such express consent, the use of derogatory words in the messages sent to applicant’s contacts amount to defamation as it tends to lower the reputation of the loan applicant in the estimation of right-thinking members of the society,” she said.

Citing the case of BEKEE & ORS v. BEKEE (2012) LPELR-21270(CA), the legal expert said the court prescribed the following as defences available to a person sued with defamation:

- That the alleged wrongdoer was not the publisher of the statement;

- That the statement did not refer to the alleged victim;

- That the statement’s meaning was not defamatory;

- That the statement was true;

- That the statement was a fair comment on a matter of public interest. -That the statement was made in the heat of an argument.”

“Where the lenders are unable to successfully plead any of the above defences, the loan applicant can be entitled to damages for defamation,” she said.

But what if the applicant has already consented to the use of these derogatory and defamatory words, would that nullify his argument for defamation? Chinenye says it won’t. This is due to the provision of Paragraph 2.4 (A) of the NDPR which says:

No consent shall be sought, given or accepted in any circumstance that may engender direct or indirect propagation of atrocities, hate, child rights violation, criminal acts and anti-social conducts.

Paragraph 2.4 (A) of the NDPR

According to the Barrister: “Assuming without conceding that the loan applicant consented to the use of derogatory words, such consent may be regarded as invalid by virtue of the above provision. This is hinged on the fact the use of such derogatory words can be regarded as ‘anti-social conducts.’”

This probably explains why loan apps won’t include a specific clause like that in their contract agreement in the first place.

Lenders actually have “safer” debt recovery options

Loan apps offer several selling points to attract loan applicants. They include collateral-less loans, little to zero documentation, instant approval and cash disbursement (5 minutes or thereabouts), and of course very low-interest rates.

The absence of collaterals and minimal documentation, however, leaves the online lenders in a tight spot once a loan applicant defaults on payment. This is practically why they resort to privacy invasion and harassment.

But are there other legal means these lenders could explore not just to get their money back, but also to avoid getting to that point altogether?

Barrister Ajayi said there are several alternatives that loan apps can explore to avoid having to harass defaulters in the future. One of them is the conduct of proper KYC (Know Your Customer) on loan applicants through credit bureaus.

“Credit bureaus provide information creditors and lenders use to help them make important lending decisions. When the track record shows a negative history about a potential applicant, the lender need not proceed with the transaction,” she said.

She also advised that the contact details of loan applicants such as house and office address, list of assets etc should be obtained and verified before granting the loan. This will enable loan app operators to trace the physical address of the applicant and file an action to recover the monies.

She also said loan applicants can be requested to provide title deeds to their assets such as land, cars, phones, or any other valuable that equals the value of the loan. The loan apps can then craft the terms and conditions to include a clause that creates a charge on those assets by virtue of the submission of the title deeds.

In the event of default, they can apply to the court to enforce it.

The Business lawyer also encouraged lenders to request open-ended direct debit mandates as they place an obligation on the bank to deduct the agreed amount every month in favour of the lender.

Finally, she advised loan apps to make the provision of guarantors with financial stability and good credit history a mandatory requirement for obtaining loans. This is particularly important for large sums. The lenders can be granted access to debit the guarantors after being notified of the borrower’s default.